The Basics of CFD Trading: How It Works and What You Should Know

The Basics of CFD Trading: How It Works and What You Should Know

Blog Article

Understanding CFD Trading: What Every Trader Should Know

Contract for Difference (CFD) trading presents investors an original way to industry financial areas without buying the main asset. It's obtained recognition for the flexibility and possibility of high results, but like any trading method, it requires talent and knowledge to succeed. Whether you're a novice or trying to refine your technique, here are a few expert tips and strategies to help you take advantage of cfd trading.

1. Understand the Principles of CFD Trading

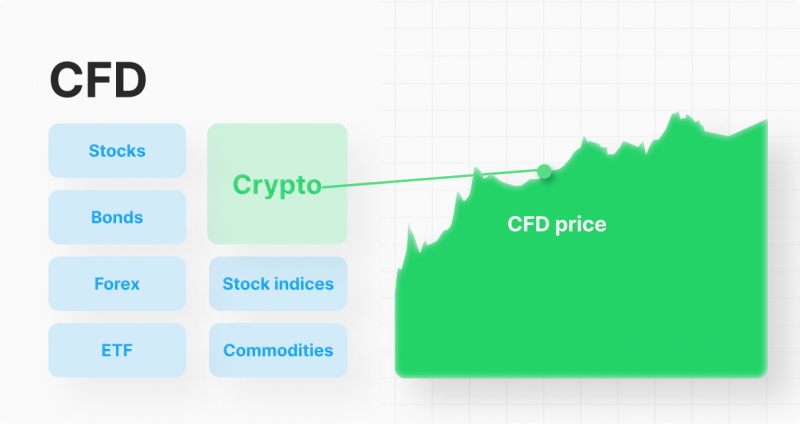

CFD trading enables you to imagine on the price action of resources such as for example stocks, commodities, forex, and indices. Once you enter a CFD business, you're agreeing to exchange the difference in the buying price of an advantage between the time you start and close the contract. This implies you can profit from both rising and falling markets.

Before leaping in, it's necessary to have a solid comprehension of how CFDs work, along with the related risks. Take some time to familiarize your self with critical phrases and methods such as distribute, margin, and agreement measurements to make educated trading decisions.

2. Use Variable Leverage Wisely

One of the very interesting features of CFD trading is flexible influence, allowing traders to regulate larger roles with a smaller money outlay. Nevertheless, while control can enhance gains, additionally, it magnifies potential losses. Use power cautiously and guarantee you are comfortable with the level of chance it presents in to your trading.

3. Produce a Risk Management Technique

A great risk administration strategy is vital in CFD trading. Always set stop-loss orders to restrict possible losses and protect your capital. Also, determine the quantity of capital you're prepared to risk per industry and stick to it. Never risk more than you are able to afford to get rid of, as trading inherently holds some level of risk.

4. Remain Current with Industry Information

CFD prices are highly affected by industry news and global events. Keeping current on financial studies, geopolitical developments, and industry belief may assist you to foresee value movements. Use reliable information resources and contemplate integrating fundamental analysis into your trading technique to create better-informed decisions.

5. Choose the Correct Areas to Business

CFD trading supplies a wide variety of markets to deal, but not absolutely all areas may possibly match your trading style. Some markets are far more risky, offering higher possible gains but additionally greater risks. Others are more secure, which may suit risk-averse traders. Evaluate industry problems and select those who arrange together with your risk threshold and strategy.

Realization

CFD trading could be a satisfying experience when approached with understanding and strategy. By understanding the basics, applying power responsibly, controlling chance, and keeping educated, you can boost your chances of success. Remember, trading is just a talent that increases with time and experience, so have patience and keep on learning as you go. Report this page